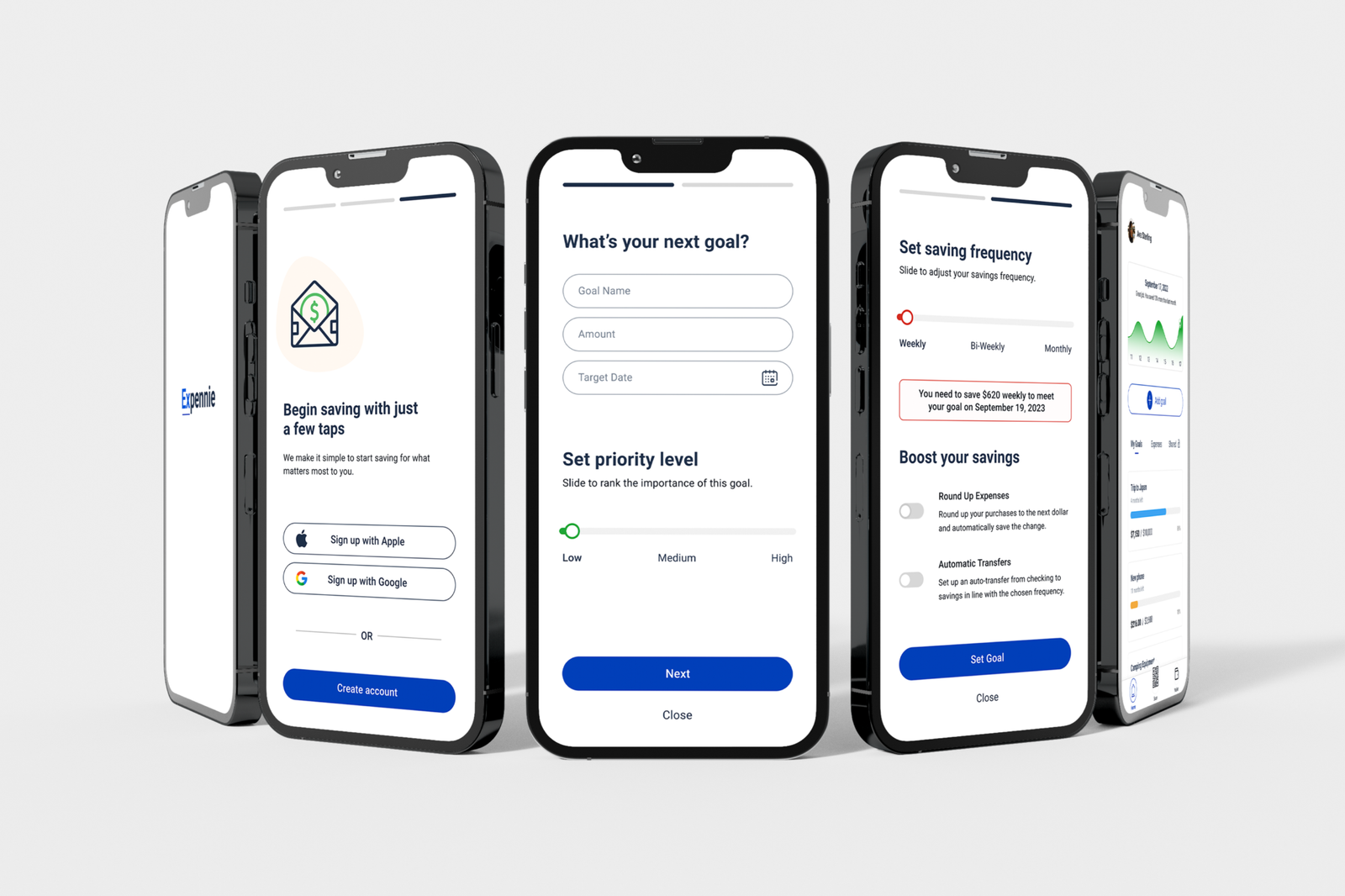

A hybrid fintech mobile application that advises users on financial journey.

UX Design | UI Design – Personal Financial Management

Objective

This project aimed to develop Expennie, a hybrid mobile application that helps individuals without a finance background easily track their income, manage expenses, and save for major financial goals. My primary focus was to design an intuitive, motivational, and personalized app that enhances user engagement in their financial journey.

Project Overview

The Expennie app transcends traditional financial management by offering personalized income accounts and expenditure monitoring. It delivers interactive flows that actively engage users in their financial journey, making it more than just a tool but a trusted economic partner.

Problem Statement

In today’s fast-paced world, many individuals struggle to manage their finances effectively due to a lack of financial literacy and the absence of intuitive tools tailored to their needs. Traditional financial management tools often overwhelm users with complex features and fail to engage or motivate them towards achieving their financial goals. This is particularly challenging for those without a background in finance who seek simple, yet effective ways to track their income, control their expenses, and save for significant life events like buying a home or planning a major trip. Additionally, there is a significant concern regarding the security and privacy of their financial data, which hampers the adoption of digital financial tools. Thus, there is a pressing need for a mobile application that demystifies financial management, offers personalized and motivational support, and ensures robust security measures to foster trust and encourage regular use.

Challenge

The primary challenge in designing the Expennie app was to create a user-centric financial management tool that caters to the needs of individuals with minimal financial expertise.

“There is a need for a tool that simplifies financial management, provides personalized support, and ensures robust security to foster trust and regular use.”

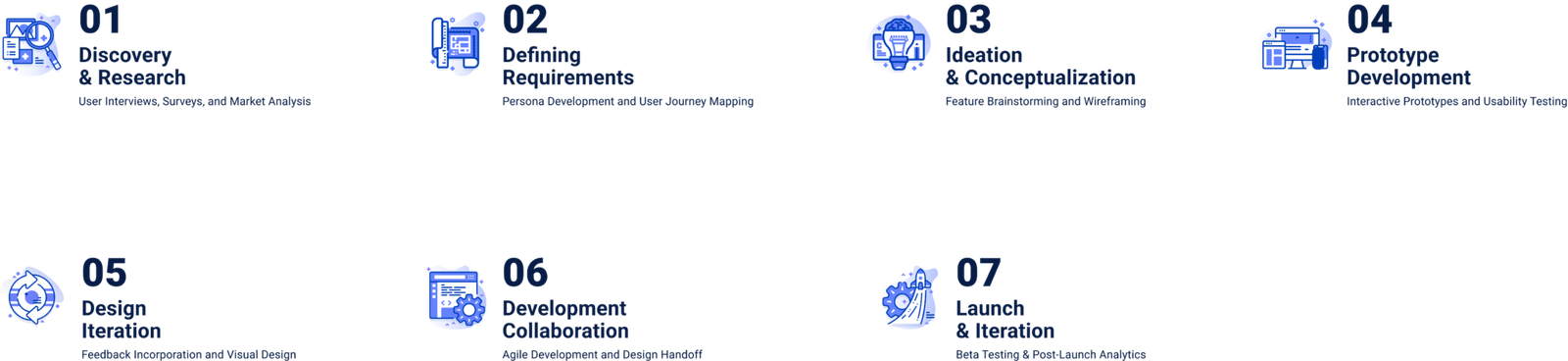

Design Process

The design process for the Expennie app was meticulously planned and executed in phases to ensure that every feature resonated with our target users.

Discovery and Research

The primary objective of the Discovery & Research phase was to deeply understand our target users’ financial behaviors, preferences, pain points, and the competitive landscape. This foundational knowledge guided the rest of the design process.

1. User Interviews

- Conducted in-depth interviews with a diverse group of potential users to gather qualitative insights.

- Focus areas included current financial management tools, satisfaction with these tools, and desired improvements.

2. Surveys

- Distributed online surveys to a broader audience to collect quantitative data.

- Questions covered topics like financial goals, challenges in saving money, and features desired in a financial management app.

3. Market Analysis

- Performed a competitive analysis to identify existing solutions in the financial app market.

- Evaluated competitor strengths, weaknesses, and identified gaps in the market that Expennie could fill.

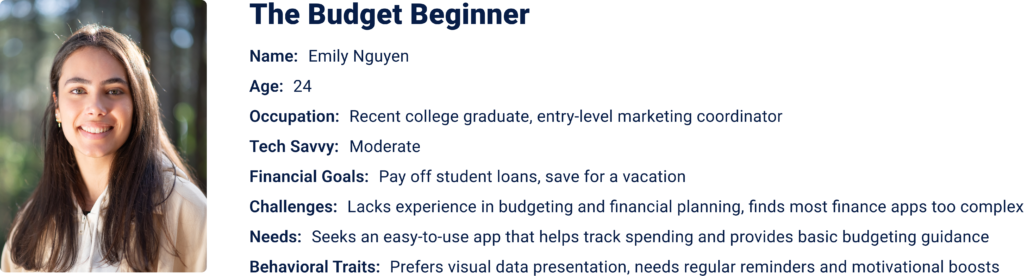

User Persona #1

User Need:

As a recent college graduate and entry-level marketing coordinator, I need an easy-to-use app that helps track spending and provides essential budgeting guidance so that I can pay off student loans and save for a vacation.

User Problem:

Managing finances effectively is challenging for recent college graduates like Emily Nguyen because most finance apps are too complex, and she needs to gain experience in budgeting and financial planning.

User Flow:

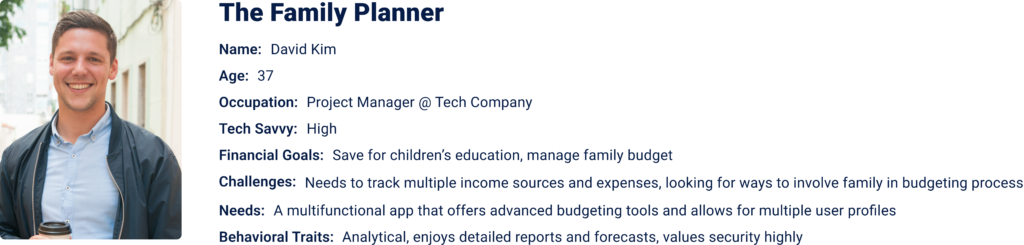

User Persona #2

User Need:

As a project manager and family planner, I want a multifunctional app that offers advanced budgeting tools and allows for multiple user profiles to save for my children’s education and manage the family budget.

User Problem:

Tracking multiple income sources and expenses is challenging for family planners like David Kim because they need ways to involve the family in the budgeting process and require detailed reports and forecasts while ensuring high security.

User Flow:

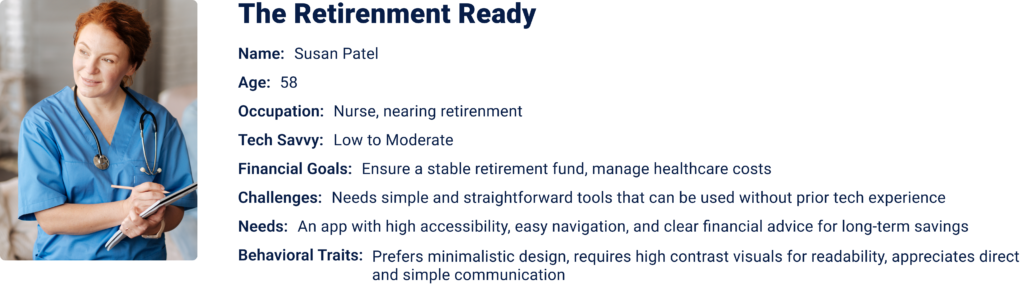

User Persona #3

User Flow:

Final UI (High Fidelity Wireframes)

Users will input personal and financial information, so they need a trustworthy product. Like an honest financial advisor, our app should be reliable and secure and build user confidence. The UI should emphasize simplicity, clarity, and intuitive design to appeal to those less familiar with finance.

Key Messaging

- “A finance app you can trust.”

- It’s like having a financial advisor in your pocket!”

- “Anyone can save money!”

- “You don’t need to be a financial expert to use our app.”